As media and social platforms get more polarized, prediction markets are gaining traction due to their fun and, potentially, profitable offering to bet on real-world events, such as elections. In this article, we will explore the existing prediction protocols, their core mechanics, and outline some future developments.

What is a Prediction Market in Crypto?

Prediction market is a platform for trading contracts based on the outcome of future events, such as elections, sports, or economic indicators. Prices in these markets reflect the collective probability of specific outcomes, as determined by traders' buying and selling activities.

Although prediction markets were present long before the first blockchain saw the light, they gained renewed popularity with the advent of blockchain technology due to its decentralized, transparent, and trustless nature. Blockchain eliminates the need for intermediaries, reduces fraud risk, and ensures that contracts are executed automatically via smart contracts. This increased transparency and security have made prediction markets more accessible and reliable for a global audience.

Why Polymarket Became so Popular in 2024

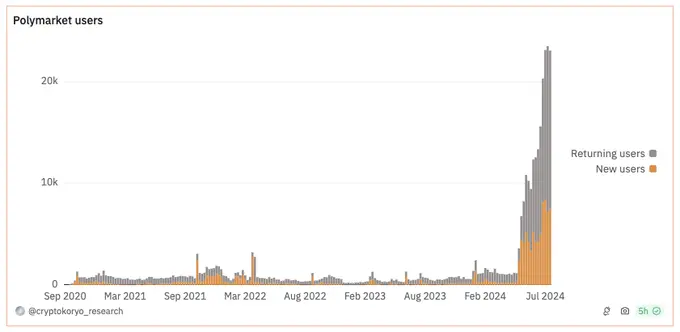

The leading protocol on the prediction market is Polymarket. It has been around since 2020, but has only been seeing the growth of its user base and activity starting from this year due to the bet on US presidential elections. Trump and Harris go very close in polls, making it hard to predict the outcome, which drives the activity on Polymarket.

Polymarket’s total value locked (TVL) has grown tenfold YTD, from $9 million to $90 million, with high numbers of both new and (especially) returning users of the protocol.

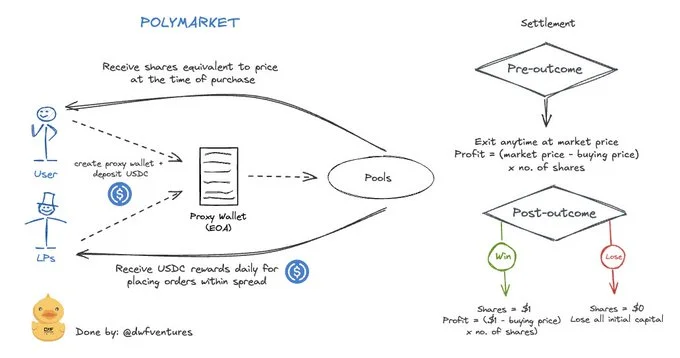

Polymarket’s core mechanics is speculation on real-world events by trading shares in different outcomes. Users buy “shares” in event outcomes based on their forecasts or beliefs, with market prices of shares fluctuating according to supply and demand. When the event resolves, those holding shares of the correct outcome get rewarded. All operations are permissionless and automated, since Polymarket is built on smart contracts.

Unlike gambling, shareholders can enter or exit the market at any time before the event’s resolution. Post-outcome, the settlement price for winners is always fixed at $1 per share.

Benefits of Prediction Protocols

Overall, decentralized prediction markets have two key edges over traditional betting platforms:

- Reducing centralization issues. For traditional platforms, the mechanism behind deciding odds and custody of user funds are entirely opaque. In decentralized protocols, odds fluctuate based on user demand with their funds being partially self-custodied, which can be verified on-chain.

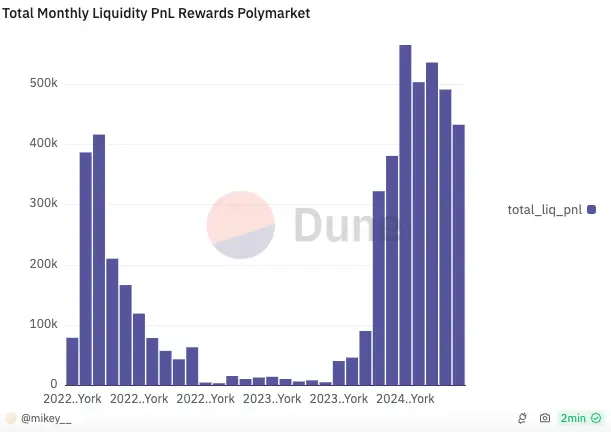

- Additional revenue streams for stakeholders. Most traditional platforms have a single counterparty who benefits from users' losses. This is not the case of prediction markets, where liquidity providers (LPs) who bet and, thus, reduce price spreads, get rewarded for their contributions. This has helped prediction protocols bolster trading volume.

To illustrate this point, here is the graph of payouts on Polymarket, which shows that the monthly amount of rewards to LPs has been over $462,000.

Potential Improvements

Prediction markets are a relatively new niche in DeFi that is still segmented and requires development for higher efficiency.

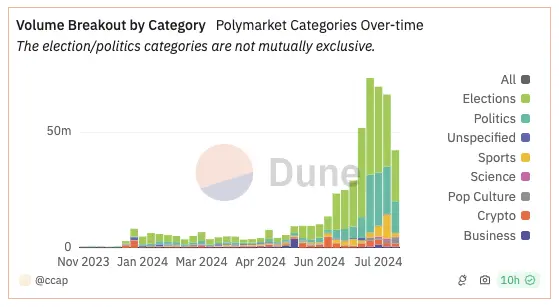

The first potential space for improvement lies in liquidity. In August 2024, over 80% of bet volume on Polymarket was centered around elections and politics:

Price spreads on other markets are bigger, which is a disincentive for users. Therefore, this would be an important factor to tackle post-elections.

The second direction of improvement is revamping the resolution process. Currently, Polymarket uses blockchain oracle from the UMA Protocol to decide on outcomes, while disputes are reviewed by a centralized committee.

As few disputes already occurred, having alternate sources and more resolving parties can contribute to further decentralizing the protocol.

Alternatives to Polymarket

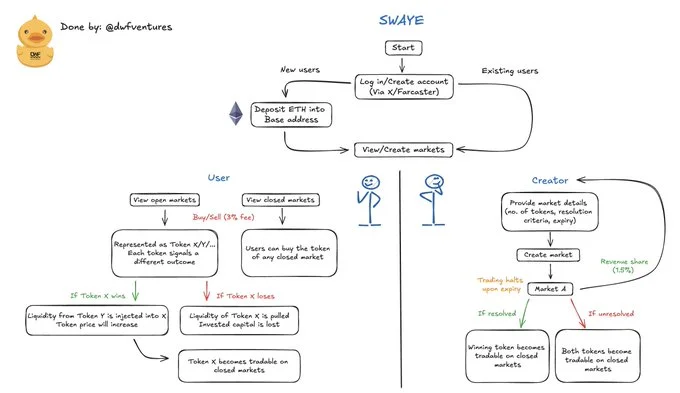

Several protocols are introducing new mechanisms to prediction markets. One of them is Swaye, which allows users to create their own markets with shares represented by tokens.

These tokens can be traded even beyond an event resolution, introducing the so-called “unlimited upside” for holders.

In the meantime, Drift Protocol is rolling out a Solana-based prediction market on their platform, allowing for deeper liquidity and hedging strategies for users. It promises better UX with the potential integration of Blinks, making users bet in one click through Twitter. Developed by Dialect, Blinks is a notification tech designed for dapps on Solana that can connect their functionality and data to X.

Overall

We’re confident that the popularity that prediction markets gained in 2024 is not temporary. They are here to stay, as the integration with everyday events broadens their appeal to a wider audience. Going forward, protocols may choose to focus on crypto users through degen features, or capture a larger market by abstracting the crypto process.

Don’t hesitate to reach out to DWF Ventures if you are working on the prediction markets and are looking for a crypto VC partner.