Introduction

The intersection of financial nihilism and cryptocurrency has fundamentally transformed the digital asset landscape, creating a new paradigm where memes transcend their role as communication tools to become powerful financial instruments. This evolution represents a significant shift in how value is created, perceived, and transferred in modern digital societies.

The rise of memecoins marks a distinct departure from conventional financial assets, embodying a unique intersection of social dynamics, technological innovation, and market psychology. What began as a satirical commentary on cryptocurrency with Dogecoin has evolved into a sophisticated market vertical that attracts significant capital flows and institutional attention. This transformation reflects broader changes in how younger generations approach investment, wealth creation, and community building in the digital age.

The memecoin phenomenon extends beyond mere speculation, representing a new form of social coordination and value creation. These tokens serve as vehicles for community expression, digital identity, and shared cultural experiences. Their success challenges traditional notions of intrinsic value and asset fundamentals, suggesting that in the digital economy, community consensus and social capital can be as powerful as traditional financial metrics.

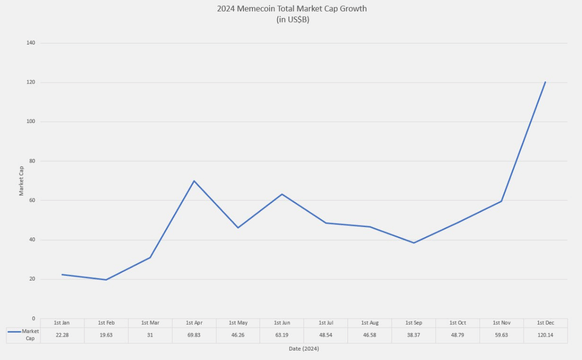

The memecoin sector has demonstrated remarkable growth throughout 2024, with the total market capitalisation expanding from approximately $20 billion in January to over $120 billion by December, representing a 500% increase.

Building Blocks

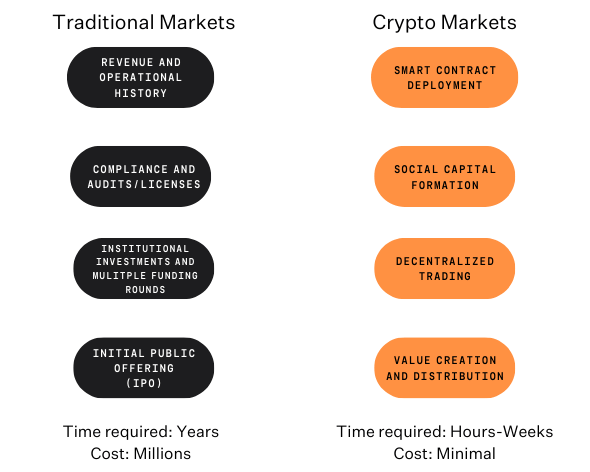

Traditional public offerings require companies to demonstrate substantial operational history, consistent revenue growth, and robust financial controls. This process typically involved multiple rounds of private funding, extensive regulatory filings, and significant professional service fees, often taking years and costing millions of pounds. The system's inherent friction served as both a quality control mechanism and a barrier to innovation, particularly for ideas that challenged conventional business models.

Blockchain technology has fundamentally disrupted this paradigm by introducing permissionless, programmatic value creation. Smart contracts have effectively removed many functions traditionally performed by financial intermediaries and regulatory gatekeepers. This technological innovation has collapsed both the time and cost requirements for launching tradable assets, democratising access to capital markets in unprecedented ways.

The reduction in friction has catalysed a new form of value creation that prioritises community engagement and narrative strength over traditional financial metrics. Projects can now rapidly test ideas in the market, with success determined by community adoption rather than institutional validation. This environment has proven particularly fertile for meme-driven projects, where shared cultural understanding and community participation create powerful network effects.

The efficiency of crypto infrastructure has established a new paradigm for digital asset creation and distribution. The rapid iteration cycles and reduced friction in value creation have led to a more dynamic and responsive market across all verticals.

The evolution from traditional capital markets to crypto-enabled value creation represents a fundamental transformation in how ideas can be funded and scaled. Historically, the path to public investment markets followed a rigid, institutional framework designed to protect investors while necessarily limiting access to capital.

This has made memes thrive.

The Meme Lifecycle

The transformation of value creation in digital assets has given rise to a new model where community-driven growth and social capital have become primary drivers of success. The traditional barriers between creators and markets have dissolved, replaced by systems and decentralised mechanisms that enable rapid deployment and community formation.

This shift has been particularly evident in the memecoin sector, where the fusion of social dynamics and financial markets has created unprecedented opportunities for value generation.

Understanding this new paradigm requires examining how projects evolve from initial concepts through mainstream trends, social media and communities to financialisation – a lifecycle that reflects broader changes in how digital communities coordinate and capture value in the modern era.

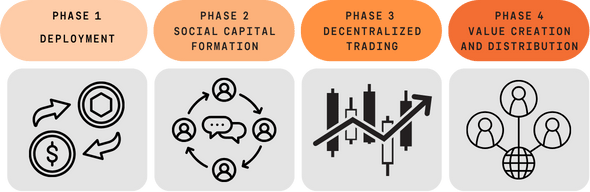

The memecoin creation lifecycle begins with technological accessibility.

Phase 1: Deployment

The journey begins when a creator accesses platforms like pump.fun or gra.fun. These platforms have transformed what was once a complex technical process into a streamlined experience. The platform(s) handle the technical complexity of deployment, smart contract verification, and initial liquidity provision. What previously required weeks of development and significant capital can now be accomplished in under an hour with minimal initial investment, dramatically lowering the barriers to entry for creation in digital markets.

Phase 2: Social Capital Formation

Once the token is deployed, the focus shifts to community building. The creator typically establishes presence across multiple social platforms simultaneously, for example:

- Twitter/X becomes the primary channel for narrative building and public engagement.

- Telegram groups serve as a platform for community coordination and communication.

- Discord channels provide structured spaces for deeper community engagement and technical discussions.

This multi-platform approach ensures broad reach while maintaining focused community development. As the community forms, three distinct but interconnected types of capital begin to develop and reinforce each other. Social capital grows through community engagement metrics, influencer adoption, and network effects.

Phase 3: Decentralised Trading

Financial capital through mediums such as optimised liquidity deployment and automated market makers create markets for such tokens to be traded amongst participants.

Market tools and social media then help participants sustain this growth through trend detection and sentiment analysis, creating a feedback loop that reinforces both social and financial capital.

Phase 4: Value Creation and Distribution

The ecosystem becomes self-sustaining when community members take active roles in value creation. Community-driven marketing replaces traditional paid promotion. Creator and user-generated content maintains engagement and attracts new participants.

This lifecycle represents a fundamental shift from traditional token launches, where success relied heavily on initial capital and institutional support. In the modern memecoin ecosystem, community engagement and social capital serve as the primary drivers of value creation, enabled by accessible technology and streamlined deployment processes.

The key innovation is how these platforms have democratised not just token creation, but the entire value creation process, allowing communities to build and capture value in ways previously reserved for well-funded institutions.

The Meme Ecosystem: More Than Just Pictures

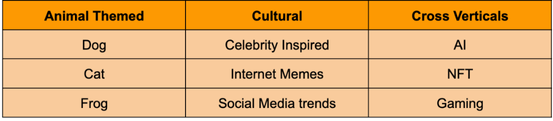

Distinct categories within the memecoin ecosystem have spawned over time, generating value across various societal themes and trends and producing significant financial returns.

This also illustrates how different memecoin subcategories can coexist and generate substantial returns, indicating market capacity to support multiple narratives in parallel – from pure meme plays to utility-enhanced tokens.

Among established memecoins, projects like DOGE and SHIB proved the viability of meme-based assets, while newer entries like WIF demonstrated the market's continued appetite for well-executed thematic launches.

However, the most compelling development has been the introduction of cross-vertical tokens that combine the viral nature of memes with utility. This is captured in AI-themed memecoins where cultural resonance of memes meets the transformative potential of artificial intelligence, creating a more sophisticated value proposition that appeals to both retail and institutional participants.

This convergence represents a significant maturation of the space: memecoins are no longer just about cultural phenomena; it has become a laboratory for experimenting with new forms of value creation that combine social coordination with actual use cases.

Conclusion

The memecoin phenomenon represents more than a temporary market trend; it signifies a fundamental shift in how value is created, perceived, and distributed in digital economies. While individual trends may come and go, the underlying structure of rapid tokenisation and community-driven value creation appears to be a permanent feature of the crypto landscape.

The growth of the memecoin sector from $20 billion to $120 billion in 2024 demonstrates that this is not a passing phenomenon but rather the emergence of a new asset class. This growth reflects the market's recognition of social capital as a legitimate source of value in the digital age. The sophisticated infrastructure that has developed around memecoins – from automated market makers to community governance tools – further cements their position as a permanent feature of the crypto landscape.

This represents not just a new market vertical, but a fundamental innovation in how society coordinates around shared objectives and distributes value. As we look to the future, the continued evolution of this market segment will likely yield new insights into how digital communities can create and capture value in increasingly sophisticated ways.

The challenge for market participants will be maintaining the creative, community-driven aspects that make memecoins unique while building sustainable structures that can support long-term growth.