- Details

The Open Network (TON) has been in the spotlight over the past year with record-breaking achievements in its ecosystem: Hamster Kombat aims for Guinness World Record, and its daily transfer volume has recently surpassed 10% of Bitcoin’s. DWF Ventures takes a closer look at the on-chain data to explore what's driving this success.

User Base Growth

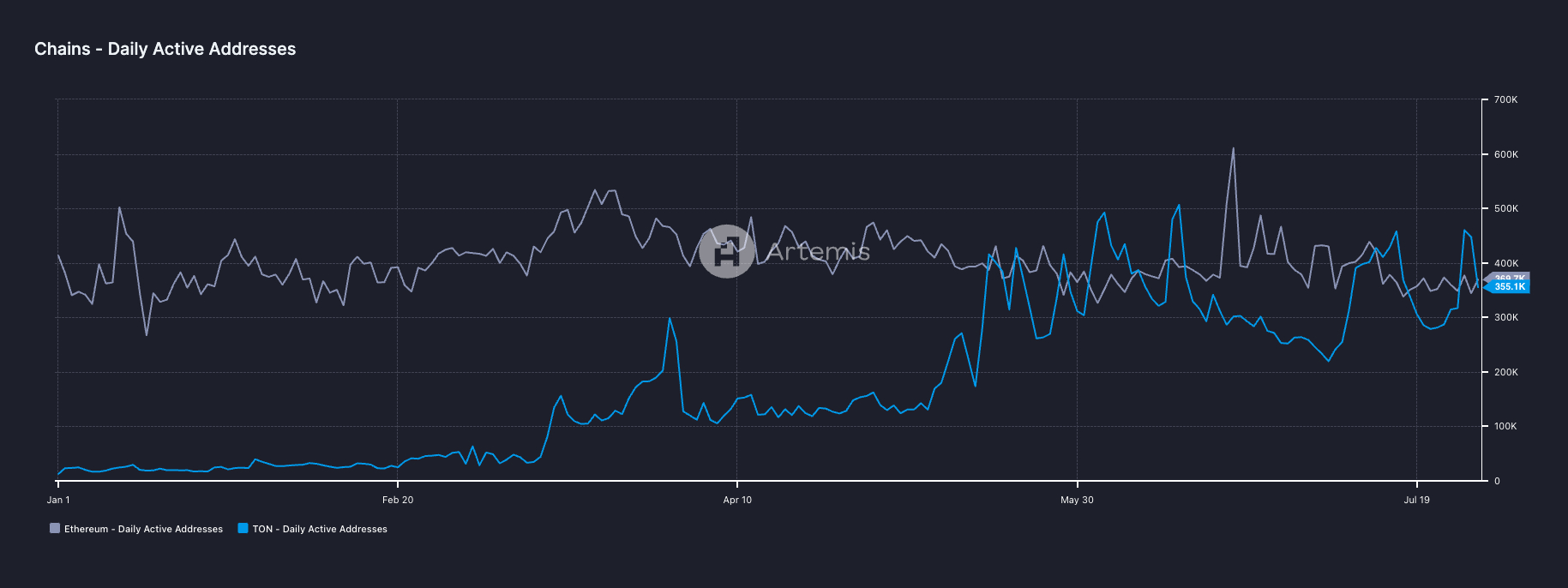

TON has seen remarkable expansion, with its daily active users (DAU) increasing more than tenfold year-to-date. The number of daily transactions per user has also grown consistently. On certain days in 2024, TON's network activity has even surpassed Ethereum’s, establishing its position as a leading Layer 1 blockchain.

Mini-Apps Craze

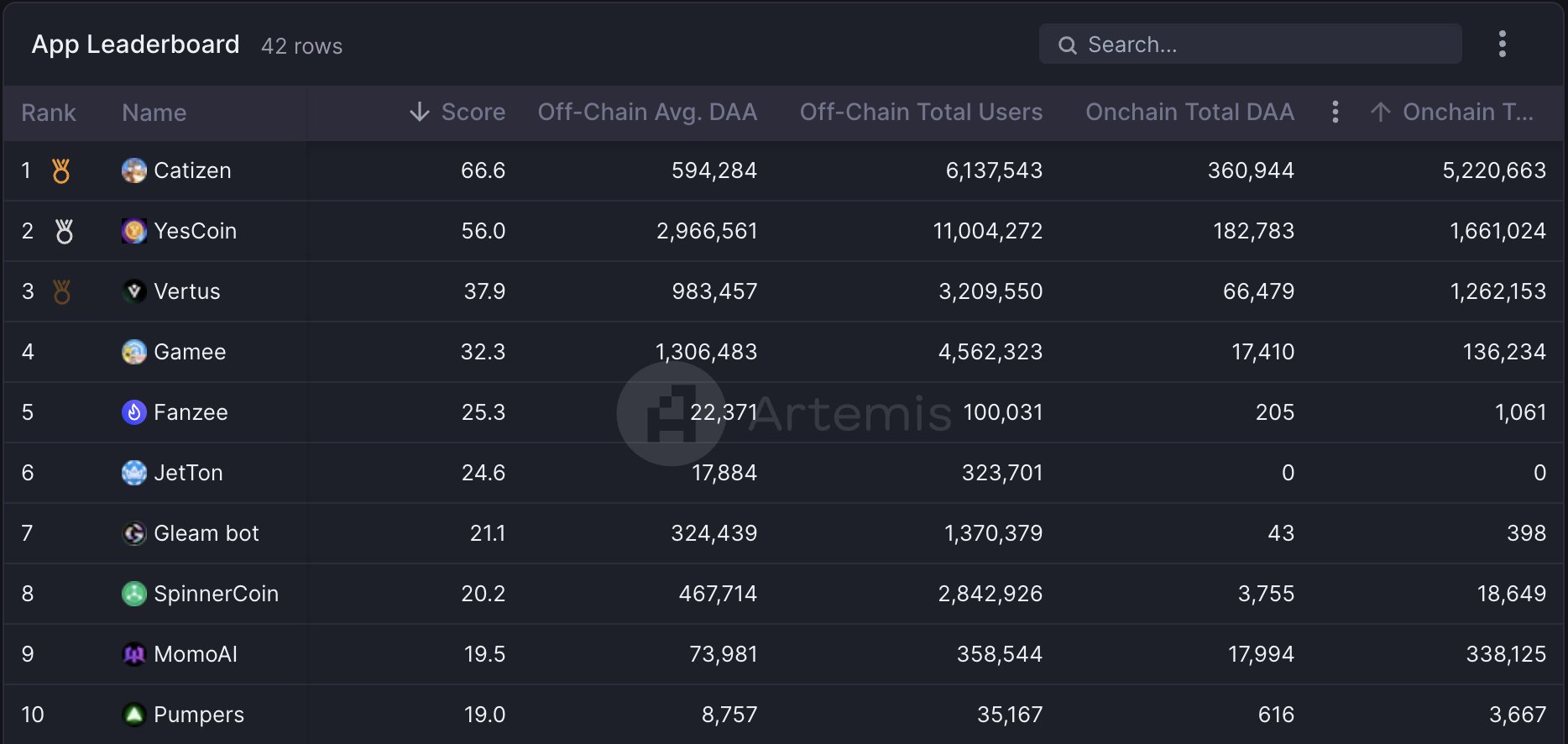

A significant driver of TON's growth is its mini-app ecosystem. Notable mini-apps such as Notcoin and Hamster Kombat have gained traction, while Catizen, a newer addition, has attracted millions of users in a short time. These mini-apps are deeply integrated with the Telegram messaging platform, leveraging its massive user base with engaging, game-like features.

According to data from The Open League 5, mini-apps have been highly successful in attracting Web2 (off-chain) users. Given the gap between on-chain and off-chain users, TON has a tremendous opportunity to become the go-to blockchain for onboarding Web2 users, similar to Solana’s success in 2021.

DeFi on TON

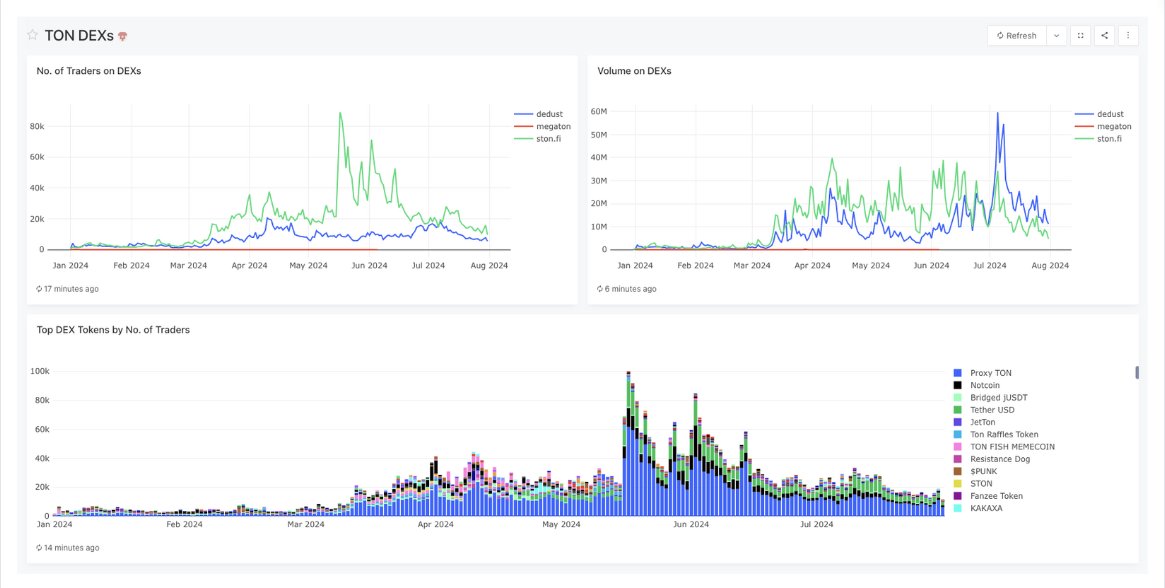

DeDust and STON are the leading decentralized exchanges (DEXs) in the TON ecosystem. While STON boasts a larger user base, DeDust has outpaced its competitor in trading volume since July 2024. The most traded tokens year-to-date are TON, NOT, and USDT. Additionally, meme tokens occasionally gain traction but tend to fade quickly.

Tether Factor

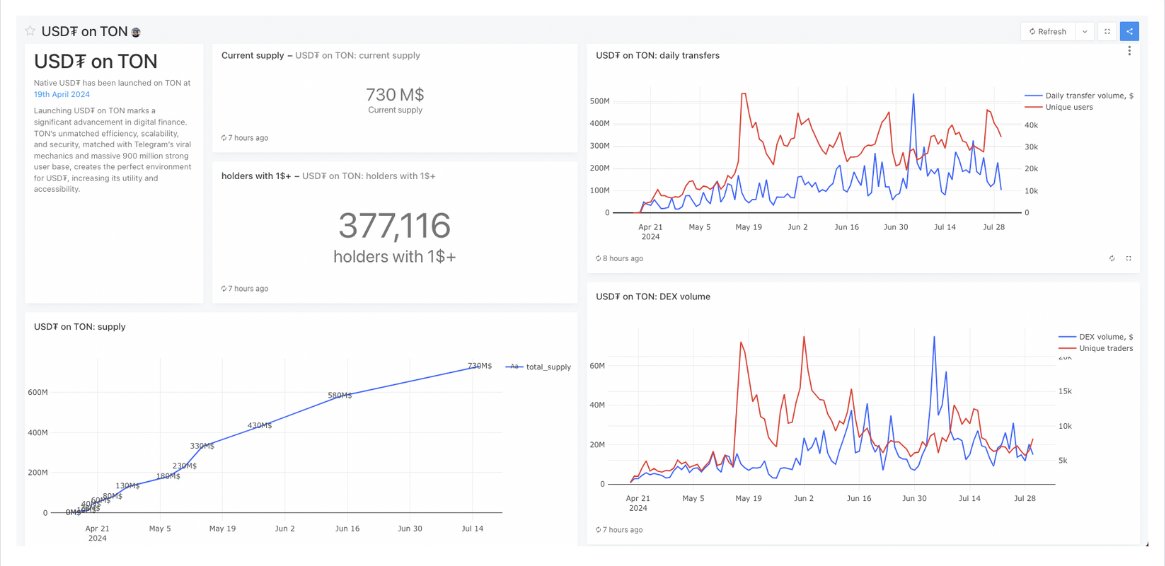

The native Tether (USDT) was launched on the TON network on April 19, 2024, and its supply surged to over $730 million within just 3 months, closely rivaling the USDT supply on Solana. This introduction has significantly boosted liquidity flows between TON and centralized exchanges, with transfer volumes reaching approximately $1 billion in July 2024.

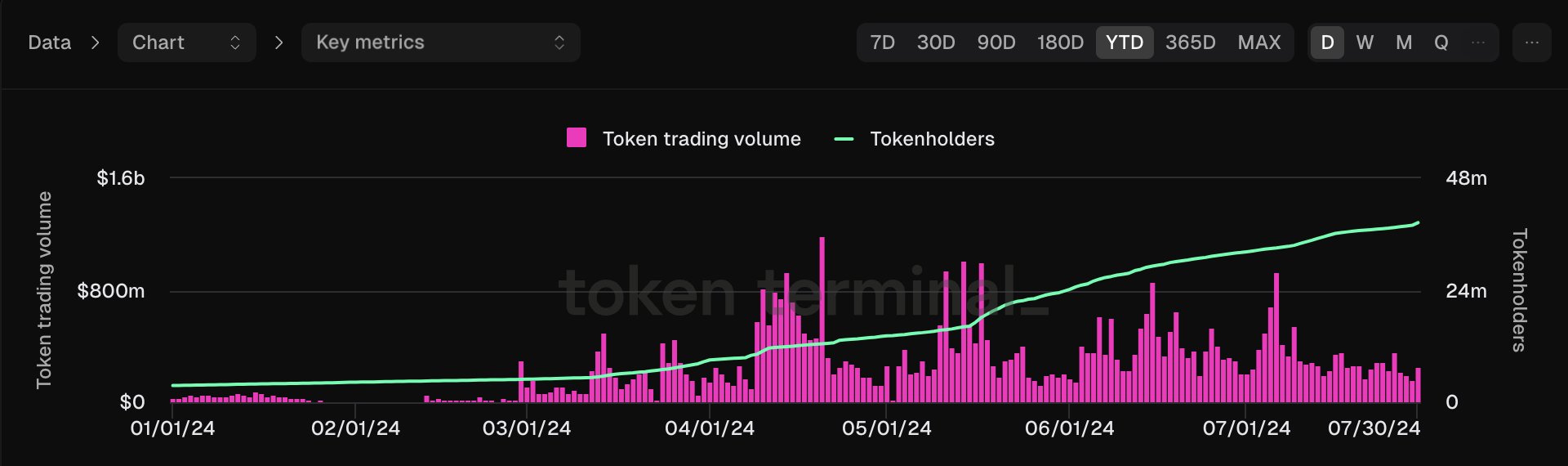

Toncoin (TON) Performance

TON's native cryptocurrency, Toncoin, reached a huge milestone in April 2024, surpassing $1 billion in daily trading volume. Although trading volumes have declined recently, the number of TON holders continues to grow, signaling increased user adoption within the ecosystem.

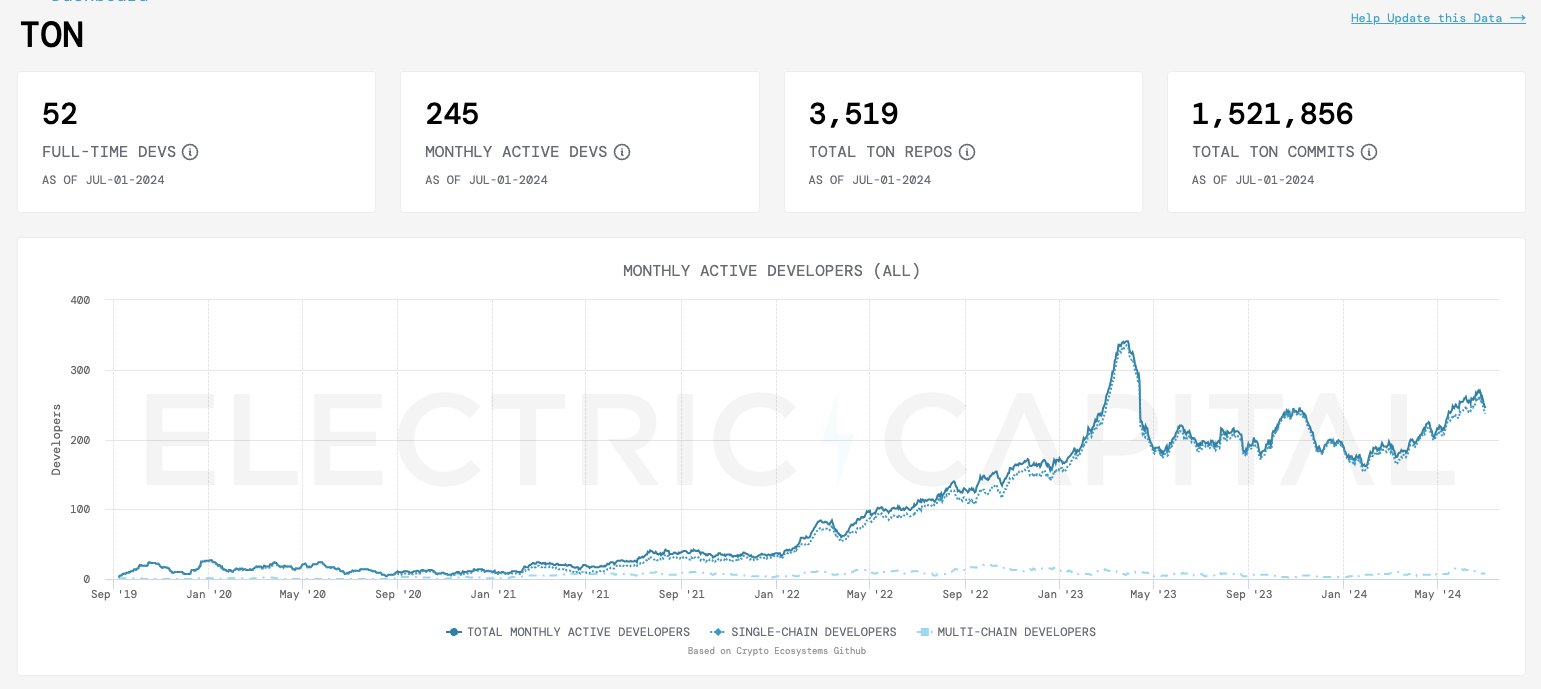

Developer Ecosystem

TON originally relied on the FunC language for writing smart contracts, which limited its developer base to those familiar with this unique language. But in 2023, TON introduced TACT, a new language similar to Rust, which has likely contributed to a surge in developer activity afterwards. The number of active developers reached a new ATH of 260 in July 2024, a promising indicator for the network’s technical future.

Overall

Beyond the buzz around mini-apps, key metrics across the TON ecosystem have been steadily improving. With the continued efforts of the TON team, the network’s growth potential remains enormous, and it is well-positioned to gain even more momentum in the second half of the year.

- Details

As market activity slows, DWF Ventures has revisited some key narratives from earlier this year. One standout is liquid restaking and liquid restaking tokens (LRT), which continue to generate interest as the space sees ongoing developments.

Here's an overview of the latest trends and insights.

Top LRT Protocols

Since our last update back in February, protocols like Etherfi, Puffer Finance, Kelp DAO, and Renzo Protocol remain leaders in the liquid restaking space. The total value locked (TVL) in the market has more than tripled since February 2024, now totaling 3.34 million ETH, equivalent to around $11.3 billion at current prices (excluding LRTs locked in liquidity pools).

Etherfi (ETHFI) vs. Renzo Protocol (REZ)

Both Etherfi and Renzo have launched their tokens, ETHFI and REZ, respectively. They have experienced approximately 70% declines from their initial ATHs, likely due to unfavorable market conditions and a lack of sustained user demand.

This raises the question: Are LRTs primarily appealing to airdrop farmers?

In both token generation events (TGEs), a significant portion of tokens was airdropped to the community. Renzo's airdrop disproportionately favored whales, as evidenced by the gap between the largest and median token holders. This likely contributed to increased selling pressure.

How can LRT protocols maintain an edge?

Following Renzo’s airdrop, Etherfi managed to capture a larger share of the liquid restaking market’s TVL. In an increasingly competitive market, attracting liquidity will rely on offering compelling incentives, while maintaining liquidity will require strong team execution and clear communication with the community.

LRT Incentives

In liquid restaking, economic incentives could include expanding to new chains or creating chain-specific LRTs. Zircuit is poised to be a crucial player, offering three sources of rewards (LRT + EL + Zircuit points) at the minimum. This structure has driven over $400 million in TVL into Eigenpie’s LRT tokens, making it a key contributor.

Chain-Focused LRT

An emerging trend worth noting is the rise of chain-specific LRTs. For example, Mantle introduced cmETH, a chain-focused LRT, through its Metamorphosis campaign.

Users can earn “Powder” by staking mETH, which converts into cmETH, a high-yield liquid staking token that receives multiple reward streams, including:

Since July 1st, the campaign has onboarded over 1,700 new stakers to the Mantle ecosystem. By enabling users to boost “Powder” production with MNT tokens, Mantle creates a flywheel effect, where value is continuously reinvested into the ecosystem and rewards its most loyal users.

New Restaking Players

The liquid staking market continues to grow, with new projects like Symbiotic and Karak Network making significant strides. Symbiotic’s TVL has reached $1.28 billion, while Karak Network has accumulated $1.04 billion in TVL.

Airdrop Farming

Crypto whales are increasingly turning to tokenless protocols like Karak Network and Swell. Notable yield farmers, including analytico.eth, have also started using Pendle's PT/YT tokens to optimize their capital efficiency in pursuit of rewards. Despite some challenges, the farming opportunities remain abundant.

Overall

Restaking remains a vital sector within the crypto landscape, despite concerns around potential risks. As AVSs continue to grow, they enhance the utilization and yield potential of LRTs, attracting liquidity and encouraging the development of new protocols on top of the LRT infrastructure. If you are building in this space and are searching for a trusted crypto VC partner, don’t hesitate to contact DWF Ventures.

- Details

The largest Ethereum conference, EthCC, has concluded in Brussels, Belgium, bringing together leaders and visionaries from the crypto industry. The DWF Ventures team had the opportunity to engage with some of the industry's top minds. Below are the key narratives we explored at the event:

- Preconfirmations & MEV.

- Chain abstraction.

- Restaking.

- AI.

- NFT and consumer chains.

In this article, we’ll provide the key aspects and promising projects of these niches.

Side Events

With nearly 400 side events held throughout the week, EthCC has established itself as one of the biggest crypto conferences of the year. Various ecosystems, projects, venture capitalists (VCs), market makers, and institutions invested heavily in sponsoring events and sending their teams to Brussels. For instance, our company hosted the DWF Labs Haus event.

VC Consensus

Participants from crypto venture capital funds noted a lack of fresh, innovative narratives in the crypto market in recent months, with many projects either being repetitive or rebranded versions of older ideas. Noteworthy themes include the shift from Security Token Offerings (STO) to Real-World Assets (RWA) and from the Internet of Things (IoT) to Decentralized Physical Infrastructure Networks (DePIN).

Preconfirmations and MEV

Ethereum developers are exploring preconfirmation, a concept aimed at improving user experience and addressing the issues of Maximal Extractable Value (MEV).

Preconfirmations allow users to receive a “promise” from a block proposer that their transaction will be included in an upcoming block, improving predictability and lowering latency. However, this approach adds complexity and trust requirements, as proposers must post collateral to guarantee their promise.

Chain Abstraction

Chain abstraction is a rising trend that simplifies blockchain interactions by enabling users to manage multiple blockchains through a single interface. This eliminates the need for separate wallets, gas fees, or network switching, allowing for seamless cross-chain liquidity and dapp interaction.

This tech opens up the possibility of more composable applications, e.g., gas and asset abstraction proposed in NEAR Protocol. It also brings opportunities for increased liquidity, as crypto assets can move freely between various blockchains.

Liquid Restaking

Liquid restaking is growing in popularity, allowing users to stake native tokens like Ethereum, receive liquid staking tokens (LSTs), and further stake these tokens in DeFi applications, thus maximizing staking returns.

Although the restaking narrative has slowed compared to previous events, such as Devconnect and EthDenver, it's noteworthy that Symbiotic is making strides since its June 2024 launch, challenging EigenLayer, Ethereum’s leading restaking protocol.

AI Crypto

AI remains a hot topic, with many events at EthCC focusing on its intersection with crypto. While AI is becoming a buzzword, projects like 0G Labs and Ora Protocol are tackling real market problems with meaningful solutions.

NFT and Consumer Chain

Leading NFT projects are increasingly venturing into the infrastructure space. The Web3 brand Pudgy Penguins attracted significant attention with its announcement of an L2 chain, while Azuki, which aims at creating a “decentralized anime brand,” unveiled its L3 chain on Arbitrum. These initiatives highlight the merging of NFT consumer influence with blockchain infrastructure development.

What’s Next?

We will continue attending crypto conferences throughout the year, seeking new investment opportunities and building connections with Web3 developers. Reach out to us if you are interested in collaborating with DWF Ventures.

- Details

Throughout the crypto market’s evolution, many Layer 1 blockchains rise and fall. Yet, Algorand, launched in 2019, continues to demonstrate steady growth. In this article, analysts from DWF Ventures will highlight its promising developments and what the future holds for the ecosystem.

Introduction

Algorand is a high-performance, Layer 1 blockchain known for its low-cost transactions and scalability. Powered by the Algorand Virtual Machine (AVM), it supports smart contracts coded in Python, making it highly accessible to developers. With tools like AlgoKit, developers can start building applications in minutes.

Recent Developments in Algorand

At the Decipher 2024 conference, several key developments were announced for Algorand. Among them, the most significant is the native support for USD Coin (USDC), enhancing on/off-ramp efficiency and broadening access for users. Other notable developments include:

- Integration with Nansen, providing comprehensive data dashboards for deeper insights into Algorand’s on-chain data.

- Establishing the Humanitarian Council in partnership with United Nations Development Programme (UNDP) and Circle, aimed at improving aid delivery through blockchain technology.

- Collaboration between Pera Wallet and Mastercard, enabling real-world USDC transactions.

Focus on RWA

With all the described developments, it is clear that bridging the gap between Web2 and Web3 is a key focus for Algorand. Real-world assets (RWAs) are an important sector as well, as they bring more liquidity and use cases for users on the chain.

Algorand has partnered with the UK-based regulated crypto exchange Archa to allow the euro-based stablecoin EURD issued by Quantoz to be used on the platform. This brings about enhanced efficiency (settlement, liquidity) and transparency.

Some protocols on Algorand tap into other types of RWAs. For instance, Lofty develops a fractional real estate marketplace, while Meld Gold aims at tokenizing the physical gold’s supply chain.

DeFi on Algorand

Although still in its early stages, DeFi activity on Algorand is poised for growth. Folks Finance is set to relaunch its liquid staking token xALGO, with upcoming changes to ALGO tokenomics, which could increase potential yields and attract more liquidity.

Additionally, the Algorand Foundation has introduced a protocol that allows developers to connect seamlessly with multiple wallets using a single integration, improving the decentralized and secure peer-to-peer communication between dapps and users.

Consumer Sector

Algorand is also making strides in the NFT and Web3 gaming spaces. Noteworthy developments include:

- Asalytic, a platform that aggregates NFTs and helps users make informed decisions.

- EXA Market, which recently launched V2 and will initiate a rewards program in collaboration with CoinList.

- Fracctal Labs, a growing Web3 game developer, is preparing to release its game Fracctal Monsters in the Epic Games Store, targeting a broader Web2 audience.

- Rxelms, a cross-chain virtual world built on the Unity engine, launched earlier this year on Algorand.

Conclusion

With its growing partnerships and developments in areas such as DeFi, RWAs, and NFT projects, Algorand shows immense potential. We are excited to support this ecosystem and looks forward to the blockchain's continued growth. If you look for a crypto venture capital to build on Algorand, contact DWF Ventures.

- Details

Ethereum Layer 2 protocol Blast is gearing up for its highly anticipated airdrop scheduled for June 26. In preparation, we made an overview of the key projects building within the Blast L2 ecosystem.

What is Blast and How It Started

Blast is an optimistic-rollup Layer 2 network offering native yields for ETH and stablecoins. Launched by the creators of the well-known NFT marketplace Blur and funded by Paradigm, Blast quickly gained attention.

Initially developed in stealth mode, Blast surprised the community with its official announcement in November 2023. Following the launch of its testnet in January 2024, Blast saw impressive growth, reaching a TVL of $600 million in just one week, making it the fastest-growing Layer 2 network at the time.

By the end of June 2024, Blast's TVL stood at $2.9 billion, ranking it fourth among the 58 L2s tracked by L2Beat.

Blast Tokenomics and Airdrop Details

Ahead of its token generation event (TGE), Blast released details of its tokenomics:

- Community: 50% (vested linearly over 3 years).

- Core Contributors: 25.5% (1-year lockup + 25% released after, followed by monthly vesting over 3 years).

- Investors: 16.5% (same vesting as core contributors).

- Foundation: 8% (vested over 4 years).

In the first phase of the airdrop, 17% of the total BLAST’s supply will be distributed the following way:

- Blast Points: 7% to users who contributed to the initial liquidity.

- Blast Gold: 7% to users interacting with Blast DApps.

- Blur Foundation: 3% to the Blur community.

DeFi on Blast

Currently, Thruster, a native decentralized exchange (DEX), is the top DeFi protocol on Blast, attracting about $454 million in liquidity. Following it, a lending protocol Juice has gained significant traction by offering users opportunities to maximize yields and earn points.

Other notable DeFi developments include Abracadabra’s launch of MIM Swap, its first in-house stablecoin-swap AMM on Blast. Additionally, multi-chain lending protocol ZeroLend has expanded its support to Blast, further enhancing the ecosystem's financial offerings.

NFT and Consumer Crypto

In the consumer sector, SocialFi project DistrictOne recently introduced Meme Labs, a launchpad designed to pool community liquidity and generate excitement for memecoins. Meanwhile, Blur, the project behind Blast, has expanded to the network, further strengthening the ecosystem's connection to its creators.

Blast Foundation

Blast recently launched the Blast Foundation, marking a transition from being managed by Arcade Research to a more decentralized governance structure. This shift signifies the project's commitment to community-driven development.

Overall

With the upcoming airdrop of the BLAST token and the advancements, DWF Ventures and DWF Labs are excited to continue supporting projects within the Blast ecosystem. The future looks promising for this rapidly evolving Layer 2 platform. Reach out to DWF Ventures if you want to partner in building up the Blast ecosystem.

- Details

The on-chain activity of Base is experiencing an explosive growth, and we have compiled an updated overview of its ecosystem.

What is Base

Base is an Ethereum Layer 2 (L2) solution built on the OP Stack, launched in August 2023. The protocol quickly gained significant attention and liquidity, largely due to its association with Coinbase and the popularity of memecoin launches.

Base On-Chain Stats

As of June 2024, Base boasts around $7 billion in Total Value Locked (TVL), placing it second among 64 Layer 2 networks, according to L2Beat. Base has outperformed major L2s like Optimism and Blast in both TVL and profitability.

Since March 2024, Base has led in on-chain profit, generating approximately $7 million in profit in May 2024, ranking it first among other major L2 networks. This growth is driven by a surge in on-chain transactions, reflecting a high level of activity on the Base chain.

DeFi on Base

DeFi on Base has seen tremendous growth, with TVL tripling since March 2024, now sitting at around $1.6 billion, according to DefiLlama. The leading decentralized exchange (DEX) on the platform is Aerodrome, holding over $600 million in TVL. However, crypto derivatives on Base remain less developed, providing room for future expansion.

Memecoins

Base is among the top three blockchains for memecoin trading, which significantly contributes to its high on-chain activity. Popular memecoins include Based Brett and Mog Coin, both actively traded and supported by enthusiastic communities.

SocialFi

In the SocialFi space, Friend.tech, a Web3 social platform allowing content creators to connect with users through the use of keys, is built on Base. Additionally, the decentralized social network Farcaster has integrated with Base and achieved notable success.

NFT

The NFT ecosystem on Base is gaining momentum, with projects like doodles recently announcing migration of its avatar customization platform Stoodio from the Flow blockchain to Base. Given Base's strong retail traffic and smooth user experience, more NFT projects are expected to follow suit.

Onchain Summer

Base has also launched its second Onchain Summer Buildathon, designed to attract builders and creators to its ecosystem. The program offers over 600 ETH (around $2 million) in prizes, grants, and gas credits. Optimism has also committed 600,000 OP tokens to the initiative.

Overall

DWF Ventures is actively exploring investment opportunities within the Base ecosystem. If you are working on projects built on Base and wish to collaborate with a leading crypto venture capital fund, please reach out to DWF Ventures directly.

- Details

The Decentralized Physical Infrastructure Networks (DePIN) sector has seen rapid growth in recent months, and Peaq Network is at the forefront of this expansion, providing an innovative platform for tokenizing real-world machines. With over 28 projects and 500,000 devices already operating on Peaq, this ecosystem continues to attract attention. We dive into its ecosystem for a deeper analysis.

Introduction to Peaq Network

Peaq Network is a multi-chain Layer 1 blockchain designed for DePIN and Machine Real-World Assets (MRWAs).

Machine Real-World Assets (MRWAs) is the term used for the tokenization of physical machines, devices, or technical infrastructure, allowing them to become autonomous economic agents in a decentralized network. These machines, whether they are electric vehicles, solar panels, robots, or charging stations, can be tokenized into digital assets, enabling owners or communities to earn revenue from their operation.

MRWAs have several key features, including:

- Machine IDs for registering and managing machines on-chain.

- Data verification, indexing, and storage for secure machine data handling.

- Payment processing for machine-to-machine (M2M) payments.

- AI agents, powered by Fetch.ai, for automating machine operations.

Ecosystem

Several prominent projects, such as NATIX Network and Silencio, are building on Peaq, contributing to the platform's growing traction. These projects help strengthen Peaq’s network, bringing more users into the ecosystem.

Peaq has also secured partnerships with well-known Web2 companies like Bosch and Mastercard. Bosch is set to run its own Internet-of-things (IoT) devices on Peaq, while Mastercard's collaboration will enable Peaq to integrate with its payment network, enhancing transaction efficiency.

Tokenomics

Peaq’s native token, PEAQ, will serve multiple functions within the ecosystem, including:

- Transaction fees for activities on the chain.

- Governance to allow token holders to influence the network’s development.

- Staking on nodes to support the blockchain’s security.

Looking ahead, PEAQ could also be used in a reputation system, encouraging machine operators to provide high-quality services, with the risk of slashing for poor performance. Additionally, stakers and node operators benefit from network rewards, aligning their incentives with the ecosystem's success and creating opportunities for “real yield” from the network’s growth.

Overall

Peaq recently raised $36 million in the largest token sale on CoinList in over two years, signaling strong market interest in its vision. With its mainnet launch on the horizon, Peaq is set to democratize access to machine ownership and revolutionize the interaction between blockchain technology and real-world devices.

DWF Ventures is proud to support Peaq Network in its mission to transform machine-tokenization and enhance the user experience in the DePIN space. Contact DWF Ventures if you want to partner with us on developing a DePIN project.

- Details

TON and Notcoin are skyrocketing!

As a long-time supporter of the TON ecosystem, we have compiled a list of projects building on it.

- Details

In the current crypto market, there is a growing intersection between off-chain geopolitical events and on-chain activity, with the upcoming U.S. presidential election being a major driving force. This convergence is primarily fueled by the rising demand for speculation, particularly in sectors such as memecoins and prediction markets, which have greatly benefited from the heightened interest in political narratives. DWF Ventures uncovered the impact of the presidential campaign in the U.S. on the broader crypto market.

Political Memecoins

Since the beginning of the election campaign in 2023, memecoins inspired by personalities of presidential candidates, Donald Trump and Joseph Biden, have gained substantial traction, amassing significant market capitalisation and mindshare.

According to CoinGecko’s PolitiFi category, some of the top-performing tokens include TRUMP, MAGA, BODEN, and TREMP, each reflecting shifting political sentiments and public perceptions over time. These tokens not only serve as speculative assets but also as tools for gauging the collective sentiment of crypto traders toward each candidate.

Political memecoins have shown considerable volatility in response to key election-related events such as debates, policy announcements, and polling results, mirroring the traditional financial market's behaviour around such milestones. Their performance underscores the increasing relevance of blockchain as a medium for political expression and speculation.

The Rise of Prediction Markets

Beyond memecoins, the growth of on-chain prediction markets has provided crypto traders with new avenues to speculate on political outcomes. Platforms like Polymarket have seen substantial engagement, offering real-time price movements that reflect the changing tides of public opinion.

As of May 2024, Polymarket recorded over $63 million in trading volumes, highlighting the growing demand for decentralised platforms that enable participants to place bets on various election outcomes.

The real-time nature of these prediction markets, combined with enhanced liquidity and improved user experience, makes them attractive alternatives to traditional betting platforms. With upcoming global events such as EURO 2024 and the 2024 Summer Olympics, DWF Ventures expects demand for such markets to surge, providing users with opportunities to speculate beyond politics and into sports and entertainment sectors.

Emerging Trends in Pre-Launch Markets

Another rapidly growing area of speculation is pre-launch markets, popularised by platforms such as Aevo and HyperliquidX. These markets allow users to bet on the anticipated fair price of a token prior to its Token Generation Event (TGE), offering speculative opportunities based on market expectations and project fundamentals. Past experiences have demonstrated that pre-launch markets have been relatively accurate in predicting token launch prices, giving both traders and investors valuable insights ahead of market listings.

Pre-launch markets provide liquidity to speculative traders and help projects gauge fair market valuations before public listings, contributing to better price discovery and informed decision-making within the crypto ecosystem.

The Future of Prediction Markets

The significant demand for prediction markets observed so far strongly suggests a product-market fit, as users continue to seek ways to engage with speculative instruments in more meaningful ways.

Beyond financial speculation, these markets offer a novel paradigm for social engagement, allowing creators and influencers to monetise their content while building stronger connections with their audience. By enabling users to wager on real-world outcomes, prediction markets create a unique intersection of social media engagement and financial speculation.

Looking ahead, we anticipate further innovation within the prediction market space, specifically enabled by blockchain technology. Key developments may include:

- Permissionless market creation, allowing anyone to launch markets without intermediaries.

- New market categories powered by on-chain verifiability, enabling unique speculative opportunities such as decentralised oracles and trustless data feeds.

- Improved incentive structures for both creators and users, ensuring better engagement and long-term sustainability of these platforms.

Overall

As speculation-driven sectors like memecoins, prediction markets, and pre-launch trading continue to evolve, their growing influence highlights the deep connection between off-chain events and on-chain activity. Whether driven by politics, sports, or financial speculation, blockchain technology is unlocking new avenues for users to participate in the broader market narrative.

We are excited about the growth potential of this sector and are actively looking to support founders and projects that are building within this rapidly expanding space. Feel free to reach out to DWF Ventures to discuss potential support from our crypto venture capital fund.